:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2159407616-c8d5972ba65d482c9a67fd8c7518e438.jpg)

Jeffrey Greenberg / Universal Images Group via Getty Images

Key Takeaways

- Official data on wages shows that pay raises have more than kept up with inflation in 2024, but in a survey of workers, fewer employees were happy with their pay than last year.

- Workers felt secure in their jobs, consistent with government data showing layoffs are low.

- The data painted a portrait of a stable, perhaps stagnant job market as the economy comes in for a “soft landing” after the high inflation of 2021 and 2022.

Does your paycheck go as far as it used to? Average pay is outpacing inflation according to official data, but many individual workers feel left behind.

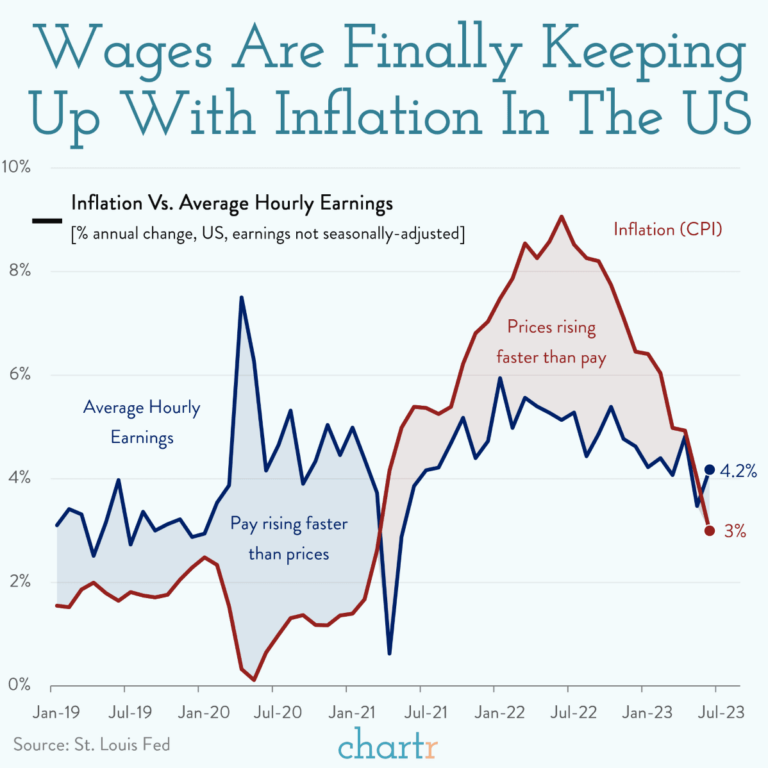

Going by official statistics, “real” wages have risen this year because pay raises have been higher than inflation. As of November, average hourly earnings had risen 4% over the previous 12 months, faster than the 2.7% rise in the cost of living (as measured by the Consumer Price Index) over the same period, the Bureau of Labor Statistics said in a report Wednesday.

In other words, wages have gone up enough that a typical paycheck buys more stuff than it did a year ago, or even before the pandemic.

Worker Satisfaction With Pay Dips

But if you feel that’s not the case with your own paycheck, you’re not alone.

Only 30% of workers said they were “very satisfied” with their pay in an October survey released Tuesday by the Pew Research Center. That’s down from 34% a year ago. Among the 29% who said they were dissatisfied with their pay, 80% said it was not keeping up with inflation.

On other questions, the Pew survey was consistent with government data showing the labor market is stable for workers, but stagnant in terms of new opportunities. Job openings have fallen by more than a third since mid-2022, when workers were in high demand. Yet layoffs have remained near record lows, suggesting that employers are holding on to their workers, if not showering them with huge pay raises.

In the Pew survey of 5,273 U.S. adults, 69% of workers said they had at least a fair amount of job security, but 52% said they would find it difficult to get a new job. In 2022, only 37% said getting a new job would be hard.

Together, the two data sources painted a picture of a job market where workers are hanging on, but are no longer benefitting from the frenzied demand for labor that characterized the job market in 2022. Employers have pulled back on hiring as high interest rates set by the Federal Reserve have made loans more costly, in a deliberate bid to slow the economy and cool inflation.

With inflation now running closer to the Fed’s goal of a 2% annual rate, the central bank is cutting rates, hoping to achieve a “soft landing” where inflation subsides without the recession that has ensued in past cycles of inflation and anti-inflation rate hikes.