:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2189830082-bad6678f51fd4c31ae39c8694473cc2e.jpg)

Piotr Swat / SOPA Images / LightRocket / Getty Images

Key Takeaways

- Shares of Rockwell Automation rose Monday after the manufacturer reported better adjusted profits than expected.

- Sales were in line with estimates, but profits beat projections as the company said its cost-cutting efforts were working.

- CEO Blake Moret said there is still “some macroeconomic and policy uncertainty” that is slowing customer spending.

Shares of Rockwell Automation (ROK) jumped Monday after the hardware and software manufacturer reported better adjusted profits than analysts had expected.

Rockwell reported $1.83 in adjusted earnings per share for the first quarter of fiscal 2025, well above the $1.58 per share that analysts had expected, according to estimates compiled by Visible Alpha. The company’s sales came in at $1.88 billion, about $10 million shy of the analyst consensus.

“We continue to deliver on our cost reduction and margin expansion projects we outlined last year,” Rockwell CEO Blake Moret said, also noting that there are “some macroeconomic and policy uncertainty” that the company believes is impacting their customers’ spending plans.

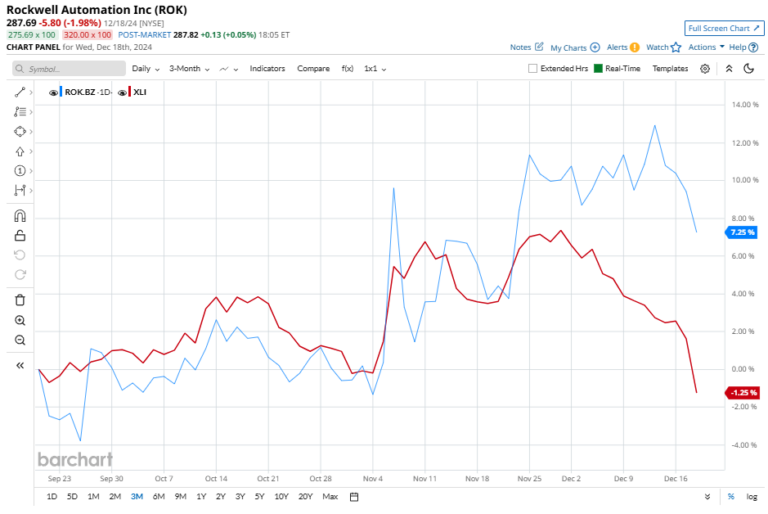

Shares of Rockwell rose around 10% Monday morning, leading the list of advancers in the S&P 500.

Rockwell lowered its full-year sales forecast, now expecting sales to decline by up to 5.5% or grow by up to 0.5% over the full year, compared to the previous range of a 4% decline to a 2% increase.

Moret said the company expects “gradual sequential improvement” in both sales and profit margins over the course of the fiscal year as the uncertainty around things like the Trump administration’s proposed tariffs is eventually resolved.