:max_bytes(150000):strip_icc():format(jpeg)/GMEChart-1ea3fd4af80548c8ab61b5a83e08d6d3.gif)

Key Takeaways

- GameStop shares will likely remain in the spotlight on Monday ahead of the video game retailer’s eagerly anticipated earnings report on Tuesday and recent meme-driven trading activity.

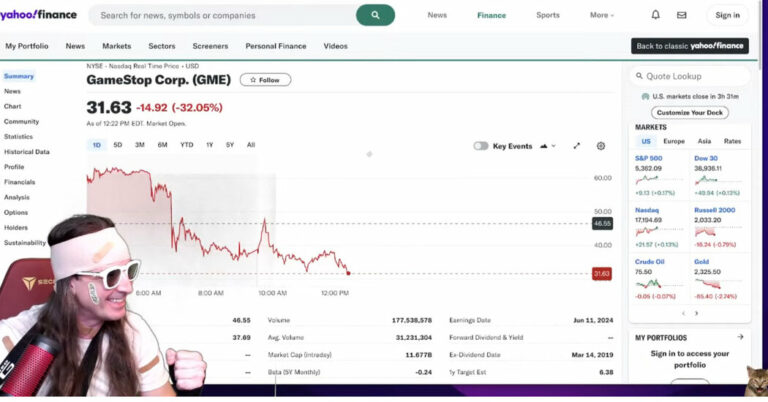

- The stock’s price formed a bullish engulfing pattern following a minor pullback on above average-trading volume.

- Investors should watch key overhead price areas on GameStop’s chart around $31 and $40.50, while also monitoring important support levels near $23 and $19.50.

GameStop (GME) shares will likely remain in the spotlight on Monday ahead of the video game retailer’s eagerly anticipated earnings report due after the bell on Tuesday, especially following a post from social media influencer “Roaring Kitty” Keith Gill that sent the stock soaring last week.

On Friday, investment firm Wedbush reiterated its “underperform” rating and $10 price target on GameStop shares, noting the brick-and-mortar company’s planned return to growth faces insurmountable barriers amid a shift to digital commerce and games streaming.

Shares in GameStop have surged more than 65% since the start of the year through Friday’s close, with most of those gains coming in May and June after Gill posted several times about the retailer for the first time since a pandemic-era meme trading frenzy gripped the stock in late 2020 and early 2021.

Below, we break down the technicals on GameStop’s chart and identify several important price levels to watch amid the video gamer seller’s looming quarterly results.

Bullish Engulfing Pattern After Pullback

Since breaking out from a descending triangle formation in late October, GameStop shares have continued to trend higher.

More recently, the price formed a bullish engulfing pattern following a minor pullback on above average-trading volume ahead of the retailer’s quarterly report.

The relative strength index (RSI) confirms positive price momentum with a reading above 60, but remains below overbought territory, giving the stock ample room a rally further.

Let’s identify several key overhead areas on GameStop’s chart to watch and also point out a couple of important support levels that may come into play during retracements.

Key Overhead Price Areas to Watch

An initial move higher could see the shares test key overhead resistance around $31, a level where they may face selling pressure near a trendline that connects last month’s swing high with a range of comparable to price points during the meme-driven volatility throughout May and June.

A decisive breakout above that price may fuel a rally up to the $40.50 level. Investors and traders who have purchased the stock at lower prices may look to offload shares around those prices.

Important Support Levels to Monitor

Amid retracements in the stock, investors should keep a close eye on the $23 level. GameStop bulls could seek buying opportunities in this region near multiple peaks and troughs that emerged on the chart from May to October.

Selling below this level opens the door for a fall to around $19.50. This level on the chart would likely attract buying interest near an important horizontal line that links the September 2023 countertrend high and several swing lows that formed between May and September.

The comments, opinions, and analyses expressed on Investopedia are for informational purposes only. Read our warranty and liability disclaimer for more info.

As of the date this article was written, the author does not own any of the above securities.