D. E. Shaw

- The biggest hedge funds are battling it out to attract and retain top talent and outperform peers.

- Business Insider has talked to elite hedge funds to get a peek into their recruiting processes.

- From internships to how they hire for tech, here’s what we know about getting a job at a hedge fund.

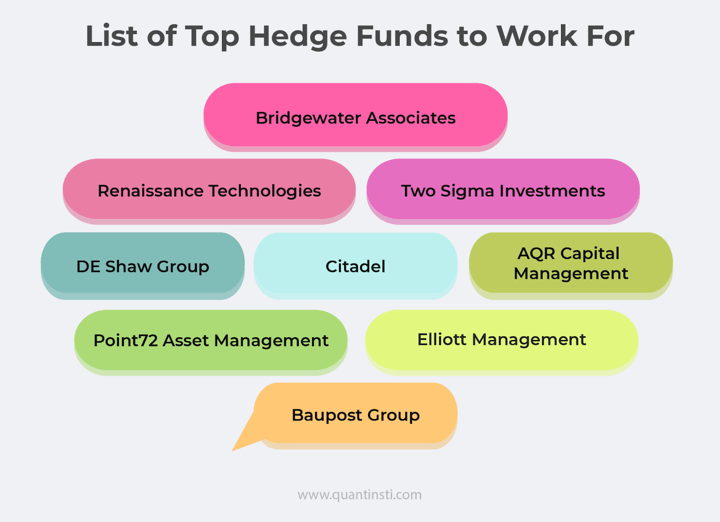

The war for the best hedge fund talent cuts across all levels and positions. Firms like Citadel, Point72, D.E. Shaw, and Bridgewater are in constant competition for the best and brightest to help them gain an edge in the cutthroat industry.

These behemoth funds are now putting serious time and resources into recruiting for internship and training programs to create a steady employee pipeline.

Eye-popping pay, prestige, challenging work environments, and the promise of working with some of the best investors in the industry means there’s a lot of competition for a spot at one of these firms.

The money is top-shelf, even for financial services jobs.

These funds, which have grown into behemoths, are now contributing serious time and resources to recruit for internship and training programs that could better guarantee them a steady employee pipeline.

Eye-popping pay, prestige, challenging work environments, and the promise of working with some of the best investors in the industry means they have a pretty attractive proposition to offer.

Internships at quant fund D.E. Shaw can pay up to $22,000. Entry-level analysts and software engineers get paid above 6 figures a year. Portfolio managers with winning strategies can take home millions.

Business Insider has talked to some of the biggest hedge fund managers about how they attract talent, as well as ways to join their ranks and be successful at their firms. Here’s everything we know.

Internships and fellowships

The opaque and secretive world of hedge funds might not necessarily be an obvious choice for many college graduates. Massive money managers are launching new programs to change that and attract young, diverse wunderkinder at earlier stages than before.

- Inside Balyasny’s ATLAS Program for High School Students

- Why Balyasny, Bridgewater, and Point72 are engaging students from underrepresented backgrounds about hedge funds

- Bridgewater’s chief diversity officer explains how the hedge fund is using its new fellowship program to create a pipeline of diverse talent in finance

Citadel

Internships have also become huge talent pipelines for some of the biggest multi-strategy hedge funds in the industry, which employ armies of traders and engineers. Programs are uber-competitive and harder to get into than many top Ivy League schools.

- Here’s how to land a spot at Citadel’s elite summer internship

- A D.E. Shaw internship could land a dream gig at the secretive hedge fund. Here’s what it takes.

- What it takes to stand out as an intern at Steve Cohen’s Point72 and land a job offer, according to 2 portfolio managers and its program director

- Citadel’s Ken Griffin’s advice to interns: Hustle during your 20s and be aggressive when asking for a promotion

Analyst and investment training programs

Typically, hedge funds acquire their investment talent after a few years of working at an investment bank. Increasingly though, the industry’s top players are paying graduates to train through intensive programs that can lead to joining investment teams straight after college.

- How to get accepted into Point72’s ultra-elite analyst training program, whose acceptance rate is less than 1%

- This Citadel training program is harder to get into than Harvard and can lead to a six-figure salary with the elite hedge fund after graduation

Even the way up-and-coming portfolio managers cut their teeth has evolved.

- How Dmitry Balyasny’s $21 billion hedge fund is looking to get ahead in the war for investment talent

- Inside Point72’s boot camp for developing all-star portfolio managers, where Steve Cohen is known to grill up-and-comers who think they’re ready for the big time

Tech jobs and training programs

Hedge funds have long been competing with the finance industry and top tech companies for top technologists. Engineers and algorithm developers are key to helping researchers, data scientists, and traders develop cutting-edge investment strategies and platforms. Quant shop D.E. Shaw also has a unique approach to finding talent.

- Why quant giant D.E. Shaw seeks out academics, doctors, and veterans to work at the $60 billion hedge fund

- Inside Citadel’s exclusive engineering program that’s helped the $47 billion hedge fund snap up talent from Google and Goldman Sachs

- Here’s how to get a job at Billionaire Izzy Englander’s Millennium, from the programing language to know to the interview questions to prep for

- Millennium is on the hunt for engineers in Miami. A top tech exec for the $58 billion hedge fund details the firm’s new training program.

- Inside Man Group’s popular training program for non-tech employees that teaches them skills to automate tasks and reduce errors in their work

Other resources, including recruiter insight and how to dominate a 5-hour interview

- Inside the hedge-fund talent war: How elite funds are battling for star portfolio managers

- The talent brokers of quant trading: The headhunters at the forefront of Wall Street’s systematic-trading and data-science hiring frenzy

- Try our searchable database of more than 350 Wall Street headhunters to find your dream job in private equity, investment banking, or hedge funds

- Meet the Gatekeepers: The top private equity, hedge fund recruiting firms to get a buy-side job

- Inside the 5-hour psychological interview that can make or break your career at Citadel, Blackstone, and other finance titans