Getty Images; Alyssa Powell/BI

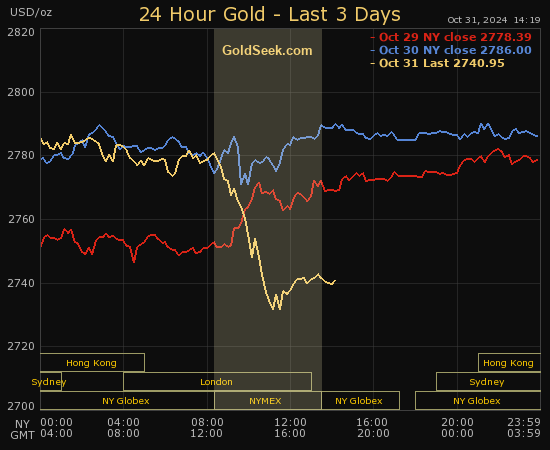

- Goldman Sachs projects the price of gold will climb 8% to $3,000 an ounce by the end of 2025.

- They cite central bank buying, Fed rate cuts, and continued safe-haven interest as reasons.

- The commodity has already risen more than 30% to records highs so far this year.

A will have more reason to keep piling into gold.

Goldman said speculative positioning has risen to high levels over geopolitical and inflationary concerns. The bank anticipates that this could normalize as uncertainty softens gradually after the election, which could prompt some near-term downside risk to the price of gold.

However, analysts wrote that gold will remain an attractive hedge in the long term amid a potential escalation of new tensions. These include trade disputes, threats to the Fed’s independence, US debt fears, and the chance of a future recession.

Read the original article on Business Insider