WealthTrack

- Canadian stocks are in a better spot than their US counterparts, economist David Rosenberg said.

- Both markets have rallied this year, but US stocks will likely trend down in 2025, he said.

- He pointed to long-run indicators in the US, like diminishing yields and high valuations.

Stocks in the US and Canada have rallied this year, but Canadian shares appear better positioned for gains in the long run, according to economist David Rosenberg.

“Time to leave New York and come to Toronto,” Rosenberg said in an interview with Bloomberg this week.

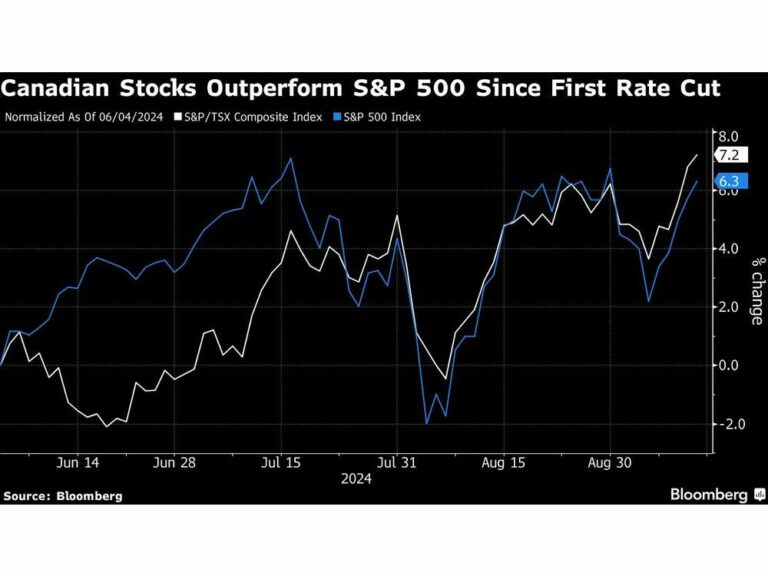

Rosenberg’s view comes amid a rally for both markets, with the S&P 500 surging 23% and the Toronto Stock Exchange up 17%. In a note to clients this month, Rosenberg forecast stock momentum in the US to peak in December before trending downward by January or February, while the TSX’s rally seems likely to continue into farther into next year.

Rosenberg pointed to a variety of long-term indicators that seem to favor the Canadian market.

As central banks around the world begin to ease monetary policy, yield has become scarce, Rosenberg says, with the dividend yield on the S&P 500 at just 1.3%.

“You have a magnifying glass? It’s almost at a record low,” he said. In Canada, on the other hand, the dividend yield is more than double that of the US at 3.3%.

At the same time, US risk assets have reached what some argue are excessive valuations.

“The United States is the poster child for that,” Rosenberg said, adding that the price-to-earnings ratio of US stocks has expanded to historically high levels in the last year.

Historically high valuations make for a significant price discount for the TSX versus US stocks, and the yield and valuation advantages in Canada versus the US make for better positioning in the long run, Rosenberg says.

“This is a relative call, but Canada, I think, at a minimum, if you go into a bear market, has much more downside protection, just based on where the valuations are,” Rosenberg said.

Rosenberg has long called for a pullback following the US stock market’s blistering rally in over the last two years. He’s warned that indicators have flashed the same warning signs of “speculative mania” that preceded the 2000 and 2008 market crashes.

Rosenberg says the S&P 500’s projected EPS growth—17% per year for the next five years—is enough to raise warning signs, and the last time that happened was just before the dot-com bubble burst in 2000.

What’s most concerning to him in the US market now, though, is a lack of diversification.

“What really has me unnerved more in the US than any other market is nobody’s rebalanced in this whole bull market,” he said, adding, “Nobody’s diversified, nobody’s taken profits.”